Lightweight, corrosion resistant composite pipes can enable oil and gas companies to explore and produce from deeper offshore oilfields. (Picture used under license from Shutterstock.com © Jaochainoi.)

Lightweight, corrosion resistant composite pipes can enable oil and gas companies to explore and produce from deeper offshore oilfields. (Picture used under license from Shutterstock.com © Jaochainoi.) Airborne's pipe structure.

Airborne's pipe structure. Airborne Group claims its composite pipe is light, spoolable and provides superior fatigue resistance.

Airborne Group claims its composite pipe is light, spoolable and provides superior fatigue resistance. Deepflex standard pipe design. (Picture courtesy of Deepflex.)

Deepflex standard pipe design. (Picture courtesy of Deepflex.) An Element Hitchin scientist inspects a reinforced thermoplastic pipe following burst testing.

An Element Hitchin scientist inspects a reinforced thermoplastic pipe following burst testing.Composites have been used for many years in oil and gas extraction. Armoured or protected pipes have been tried. Equipped with better quality composites and stimulated by the considerable financial rewards some suppliers of composite pipes are demonstrating that they can substantially reduce losses caused by corrosion in conventional metal pipes.

Thermoplastic composites are leading the surge. According to information published in 2009 by the Gale Group the use of thermoplastic composite materials “has increased rapidly over the last decade and there is every indication that this trend will continue. The attraction of thermoplastic composite materials primarily stems from its ability to replace standard light-weight/high-strength metals with even lighter-weight/higher-strength alternatives.”

Another driver has been the enormous demand. In July 2002 a report produced by Patrick Laney, Idaho National Engineering and Environmental Laboratory, USA, evaluated opportunities for the use of composite pipe in the natural gas industry.

Laney said that “by 2015 some 43,000 miles of pipeline additions will be required to satisfy an expanding market.” Other estimates for North America predict more than 50,000 miles of new transmission pipeline being built in the 2001-2010 timeframe at a cost of over $80 billion.

Laney continues: “The challenge to the pipeline industry is to meet the increased worldwide demand while reducing the cost. The US Energy Information Agency predicts that the price of natural gas on the average will be in the $3 to $4 range through 2020. In order to meet the delivery demands and overcome the flat price, the pipeline industry will have to come up with innovative methods to transport natural gas from wellhead to household and commercial users.”

In the offshore industry there are also enormous opportunities, particularly in developing countries. In October 2012, Composite Pipes Industry, an Omani manufacturer of pipes, announced its entry into India with its plans to set up a 5000 tonnes manufacturing facility by 2013 with an initial investment of Rs 50 crore.

According to Composite Pipes Industry “demand for composite pipes from the oil and gas sector alone is expected to grow at 9-10% CAGR [Compound Annual Growth Rate] over the next five years. The global demand for epoxy-based pipes has been estimated at 216,000 tonnes per year while India has an annual requirement of 4.6 tonnes of GRE (glass reinforced epoxy) pipes. The 12th Five-Year Plan of Government of India has estimated the requirement at 18,000 km of pipelines with an investment of US$9 billion by 2015.”

In the West many companies have developed composite pipes for use in oil and gas extraction. Two prominent ones are Airborne Group and DeepFlex.

One-material concept

Airborne, which is based in the Netherlands, says that an estimated 50% of leakage issues are caused by corrosion. It claims it is the first company to have developed a fully bonded thermoplastic pipe which will not corrode. Airborne claims its product is also light, spoolable, and provides superior fatigue resistance.

“We are now the world’s first and only manufacturer that has succeeded in making continuous solid thermoplastic composite pipe”, claims Martin van Onna, Commercial Director, Airborne Group.

“This is different from RTP, or Reinforced Thermoplastic Pipe, in that RTP is often unbonded, so loose fibre layers or tapes are wound around the liner. RTP cannot withstand external pressure and cannot be used offshore in deep waters.“

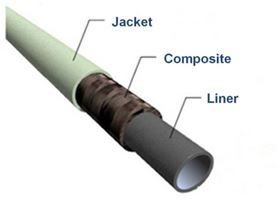

Airborne’s pipe consists of a thermoplastic compound and there are three components:

- a jacket;

- composite; and

- liner.

The liner is made from a thermoplastic. Glass or carbon fibres provide strength and stiffness. During manufacture the fully bonded flexible pipe is melt-fused; the pipe consists of one solid wall.

“We mainly use glass fibres, E-glass and S-glass,” explains van Onna.

“We also use carbon fibres. We do not use aramid fibres as they are not good in compression (so a pipe made from aramid cannot handle high external pressure). We use the fibres in tapes, whereby the fibres are impregnated with a plastic. We impregnate them with the same plastic as the liner. Thus, we wind the tapes around the liner and melt-fuse them onto the liner, the next tape onto the underlying tape etc.“

van Onna explains that for the composite material Airborne uses polymers such as polyethylene (PE), polypropylene (PP), polyamide (PA), polyvinylidene difluoride (PVDF) and polyether ether ketone (PEEK). He reports that when the company makes a composite pipe out of PP it starts with a PP liner, then it melt-fuses glass/PP tapes onto that PP liner and on the outside it melt-fuses a PP jacket. Airborne claims that this method creates a strong and stiff pipe made out of one polymer and one fibre system.

The manufacturing process for Airborne’s pipe is confidential. van Onna says that the process is complex and that the “complexity lies in the ability to manufacture long lengths, of continuous pipe, whereby the production technology is qualified by DNV for the manufacturing of qualified products.” He adds that Airborne aims to manufacture continuously with small variations, and complete repeatability.

Petronas, the national oil and gas company of Malaysia, in an effort to mitigate the effects of anaerobic sulphate reducing bacteria (SRB) induced corrosion, has awarded Airborne with a contract to qualify its thermoplastic composite pipe for use in offshore hydrocarbon production. The project will yield qualified 6 inch internal diameter (ID) thermoplastic composite flowline (TCF) with minimum working pressures ranging from 100 to 375 bar.

The project scope comprises a client specific qualification programme to the requirements of American Petroleum Institute (API) standards API 15S and API 17B and Det Norske Veritas (DNV) standard DNV-OS-C501, including extensive materials testing, short-term and long-term prototype testing and full scale offshore installation testing. Also part of the programme is the development and testing of integrated optical fibre condition monitoring and upscaling of the technology to sizes of 16 inch ID.

Airborne explains that with the qualified non-metallic TCF, Petronas will lower the total cost of ownership of its in-field pipelines “by lowering installation and operational cost and by extending the design life of the pipelines. Compared with steel pipelines, the installation of the TCF does not require expensive pipelay vessels; it will be installed cost effectively from lay-barges carrying the light weight transport and installation reels or carrousels. In operation, corrosion mitigation by injection of biocides is not required.”

Airborne also reports that the frequency of pipeline inspection by pigging can be reduced, while inspection by intelligent pigs to monitor pipewall thickness is completely redundant. It notes that perhaps the greatest benefit will be found in the much longer lifetime expectancy as premature replacement or rehabilitation of pipelines due to corrosion will belong to the past.

Longest composite downline ever made

For the Guara & Lula NE Gasline deepwater project in the Santos Basin of Brazil the challenge was to deliver the longest composite downline ever made for pre-commissioning works between depths of 2,100 and 2,200 m. With this project, Airborne claims that at a depth of 2,140 m it achieved the depth record for the use of a composite downline.

In April 2011 oil and gas industry contractor Saipem was awarded an EPIC (Engineering Procurement Installation Commissioning) contract for the Guara & Lula Northeast gas export pipelines, in the Santos Basin, approximately 260 km (162 miles) off the coasts of the Rio de Janeiro and São Paulo States, in water depths of between 2,100 m and 2,200 m. The two export sea-lines each 18 inch in diameter and with lengths of 54 km and 22 km long will be installed by Saipem.

According to Airborne the total scope of supply consists of a 3 inch internal diameter downline with a total continuous length of 2,500 m (8200 ft). The 3 inch downline is designed for an internal working pressure rated at 345 bar (5000 psi) and can hold external pressure of 250 bar (3626 psi).

Unbonded composite pipe

DeepFlex also offers a composite pipe.

“Unbonded flexible pipe has been around for 30 years,” says Duane Moosberg, Vice President of Sales and Marketing. “We led the development of an annex to the API standard.”

DeepFlex describes its flexible pipe as a multilayer structure of helically wound metallic strips and tapes and extruded thermoplastics. These multiple unbonded layers are:

- the internal liner, composed of extruded polymer, provides smooth, chemically resistant transportation of hydrocarbon fluids;

- two layers of laminated composite tape provide resistance to high internal pressure;

- the hoop layer provides support against collapse;

- a polymer membrane in the middle of the pipe wall is surrounded by a layer of composite tape laminates that provide tensile strength; and

- the outer jacket provides further support and protection from abrasion and the external environment.

DeepFlex says the pipe layers are unbonded to enable independent movement and provide superior flexibility.

It says that the tensile armour layer in conventional pipe consists of high strength steel rectangular wires wound in opposing directions to provide torque balance.

DeepFlex’s design incorporates carbon fibre thermoplastic composite strip instead of steel armour.

“A weight reduction of 30% is expected for a pipe designed to meet the same performance requirements,” says DeepFlex.

DeepFlex explains that non-bonded flexible pipe has been applied in the offshore oil and gas industry for about 20 years. It is used for dynamic risers connecting seabed flowlines to floating production facilities, and for static seabed flowlines where it is more cost effective to install than rigid pipe, such as in harsh environments, or where it is desired to recover the flowline for reuse after a short field life. For dynamic applications DeepFlex says extruded polymer or tape polymer antiwear layers are applied between adjacent steel armour layers. For extremely high pressure applications, an additional layer of rectangular shaped helical reinforcement over the interlocked hoop strength layer, or a second set of tensile armour layers, may be applied.

A 9.125-inch 207 barg oil export flexible riser system designed for service in 1500 m water depth at the P36 semisubmersible platform in Brazilian energy company Petrobras’ Roncador field has been developed. This riser features a free hanging catenary consisting of two sections. The top section is designed for high tension capacity and lower collapse resistance. The bottom section is designed for lower tension capacity and high collapse resistance. The top section employs composite material for the tensile armour layer. The bottom section is designed so that the hoop strength layer provides a higher contribution to the pipe collapse resistance. These design attributes were implemented to meet the design requirements while maximising weight reduction and minimising top tension. In a floating production application, the installation vessel and operating platform or vessel as well as the top section of the pipe itself, must support the hanging weight of the remainder of the pipe with dynamic loading.

According to DeepFlex it is desirable to reduce the weight of the pipe to minimise stress on the pipe wall and hangoff structure. It is also desirable to reduce the vessel deck loads so that buoyancy requirements are reduced or payload capacity increased.

In addition DeepFlex claims the composite armour offers the advantages of being highly fatigue resistant, and essentially inert to corrosion, hydrogen induced cracking and sulphide stress cracking, all potential mechanisms for reducing the service life of a pipe.

DeepFlex adds: “The use of the different structures for the top and bottom section and the dry hoop strength layer design resulted in a reduced cost when compared to the conventional design.”

The American firm has a contract with Petrobras to conduct a qualification testing programme on DeepFlex’s patented composite flexible fibre reinforced pipe components. This multi-phase, multi-year contract will include over 5000 individual tests. According to DeepFlex the contract award demonstrates Petrobras’ commitment to qualify DeepFlex’s products for offshore applications. Petrobras and DeepFlex have been working in close cooperation for over a year to develop the specifications and scope of the programme which resulted in the contract award. The qualification programme scope includes the composite materials required for the design and development of a high temperature, deepwater pipe with a 20 year service life.

New ISO standard for oil field composites

Airborne and DeepFlex are buoyant about prospects for greater specification of their products, but the lack of standards is holding back greater use.

In the report Composite Materials: An Enabling Material for the Oil and Gas Industry written by Dr Rod Martin, Chief Executive, and Dr Morris Roseman, Senior Scientist, Element Hitchin, work on the standards was outlined. (Element Hitchin previously traded as MERL, the Materials Engineering Research Laboratory, which is based in Hitchin, Hertfordshire, UK. In July 2012 Element Materials Technology acquired MERL, renaming the facility.)

The 2007 report discussed some of the barriers facing the uptake of composites in the oil and gas industry. Two of the barriers identified were a need for new standards for composites in these challenging applications and relevant performance information in hostile media. With composites becoming an enabling technology in this industry, in the absence of qualification standards, they will be used and qualified for fitness for purpose on an application by application basis with the involved parties agreeing amongst themselves on tests involved.

Martin and Roseman continue: “A DNV standard entitled ‘DNV-OS-C501 Composite Components’ goes some way to addressing test methods to use. However, it is non-specific for many applications and environments on what specific conditions to test under. Hence, an initiative as part of ISO Working Group TC67/WG7 has started the work to write an ISO standard for composites in contact with oilfield media as part of the suite of standards on non-metallic materials being developed by ISO as ISO 23936.”

Airborne’s van Onna believes the standards will accelerate specification of polymer composites in the oil and gas industry and will particularly help at the tendering stage.

“When we send out a document to qualify it is a fairly complex process,” he says. “Currently our customer cannot send out a tender for the new composite technology. Often they can only send tenders for conventional flexibles. That is why recently we have seen some oil companies asking in the tender documents for qualification programmes for these new composite technologies.”

Those standards will only be effective if compliance procedures are in place. Another concern is that materials submitted for laboratory analysis may be different to ones actually used.

This is an important issue and the subject of an Element Hitchin project called Specification for Qualifying Composite Materials in Contact with Oil Field Media.

According to Element Hitchen: “Standards (e.g. ASTM, ISO etc.) are generally written around the testing of flat samples of simple rectangular geometry. Samples for compliance to these standards are generally manufactured in a laboratory, and hence bear little resemblance to the material from which actual components are made, as with composites, the material is made at the same time as the component, the properties of which are highly dependent on the processing parameters, fibre direction etc. (You cannot buy a lump of composite material off the shelf and make a component from it as you can with metal). This JIP therefore aims to consider existing standards and use them to draft a specification directly relevant to specific composite components used in the oil and gas industry by considering how the components will be used in service, and to write a qualification procedure around this.”

Element Hitchin is also working on two other projects that will affect the future use of composite pipes in the oil and gas industry:

- PIPEAGE – Developing Ageing and Chemical Resistance Data for GRP Piping and Repair Material. GRP piping currently used for fluid transfer may have been in service for 20-30 years. There is currently no way of predicting how or when these pipes will fail (maybe catastrophically);

- CQCC – Continuous Quality Control for Composites for the Next Generation Flexible Pipe. Much research is being carried out to develop risers from composite materials. The depth to which metal risers can operate is reaching its limits given the inherent weight of metal. As the depth becomes greater, the pipe wall section needs to increase to withstand the high external under water pressures, but this adds weight to the pipe which needs to support its own weight. Composites are lighter and hence greater depths can be reached. Composite pipes would be made in a continuous winding process, but there is currently no system that can monitor and repair defects to the pipe as it is being manufactured. The aim of this TSB (Technology Strategy Board) funded project is to design and build an inspection module to detect manufacturing (or man-handling) defects, and to then design and build a module than can repair the defects (the resins used in the pipe manufacture are thermoplastic).

These projects are likely to stimulate greater use of composites in oil and gas extraction. The next major challenge could be subjecting these materials to the harsh conditions found in the Arctic. This is now a major environmental and political battlefield. As global demand for energy continues to rise the pressure on materials is bound to increase still further. ♦

This article was also published in the January/February 2013 issue of Reinforced Plastics magazine.

The digital edition of Reinforced Plastics is distributed free of charge to readers who meet our qualifying criteria. You can apply to receive your free copy by completing the registration form.